IRS 1125-A 2024-2026 free printable template

Instructions and Help about IRS 1125-A

How to edit IRS 1125-A

How to fill out IRS 1125-A

Latest updates to IRS 1125-A

All You Need to Know About IRS 1125-A

What is IRS 1125-A?

Who needs the form?

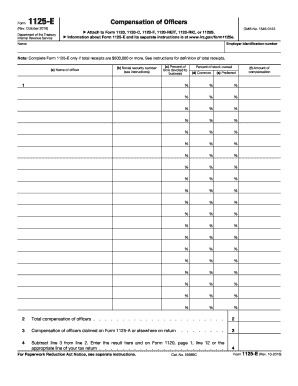

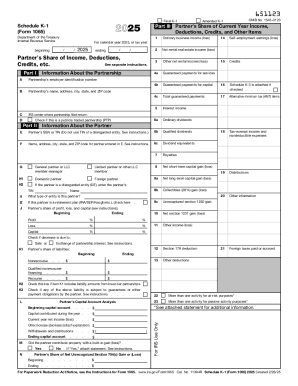

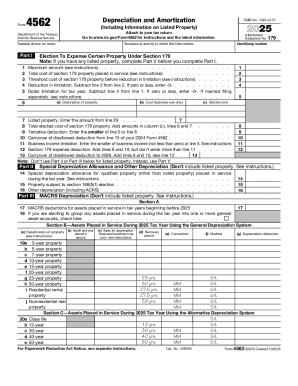

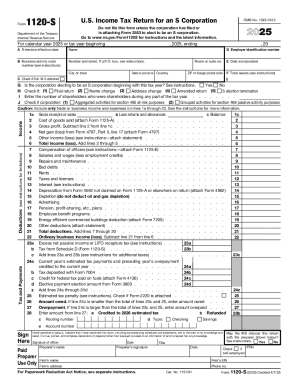

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1125-A

What should I do if I realize I've made a mistake on my IRS 1125-A after submission?

If you've discovered an error on your submitted IRS 1125-A, you need to file an amended return. Use the correct form and indicate that it is a correction. It's important to submit this amended IRS 1125-A as soon as possible to avoid potential penalties and ensure accurate reporting.

How can I track the status of my IRS 1125-A submission?

To verify the receipt and processing status of your IRS 1125-A, you can use the IRS's online tracking tools or contact their helpline. Be prepared with your submission details for reference. Remember, e-filed forms may have different processing times compared to paper submissions.

What measures should I take to ensure the privacy of my information when filing IRS 1125-A?

When filing your IRS 1125-A, it is crucial to use secure methods, especially when e-filing. Make sure to utilize encrypted channels and secure software. Keep records safe and ensure that any authorized representatives have valid power of attorney to maintain compliance with privacy regulations.

How can I avoid common errors when completing my IRS 1125-A?

To avoid mistakes on your IRS 1125-A, double-check all entered data for accuracy, ensure proper formatting, and verify that all necessary supporting documents are attached. Utilizing reliable tax software can also help minimize common errors by guiding you through the filing process.

What should I do if I receive a notice from the IRS regarding my IRS 1125-A?

If you receive a notice or letter from the IRS regarding your IRS 1125-A, carefully read the correspondence to understand the issue. Respond promptly with the required documentation or explanations, and consider consulting a tax professional if the matter is complex or if you're uncertain about how to proceed.

See what our users say